Climate Action

HOW BUSINESS IN THE COMMUNITY IS SUPPORTING ORGANISATIONS TO TAKE CLIMATE ACTION

There is no time to lose if we are to keep global temperatures at a stable level for humanity. Every business, regardless of size or sector, must take climate action now.

Responsibility goes beyond company boundaries. We must deliver a fair and inclusive journey to a net zero, resilient future where people and nature thrive.

Business in the Community (BITC) members are taking climate action. Join us to accelerate progress, maximise business opportunities and secure a future for us all.

Community Climate Fund

Our Community Climate Fund will help businesses and communities come together to tackle both the climate and cost-of-living crisis at the same time. Join us as a partner and give your business the chance to bring lasting benefit to communities.

2030 Manifesto-Our Route to a Net Zero Climate Resilient Future

This manifesto sets out our vision for 2030 – a key milestone for a just transition. Targeting businesses and policymakers, it identifies priority actions for businesses across our Seven Steps for Climate Action and five key areas where policy support is critical.

Key facts: Innovating to sustain and repair our planet

- 72% of people want businesses they buy from to take climate action. Almost two-thirds (62%) do not trust businesses to do what they promise.1

- Over half of people (52%) do not think they will need new skills to be successful in a net zero economy. Of those that do, 57% think employers are not preparing them.2

- £1.1 trillion of the costs of climate impacts to society could be avoided if UK businesses achieve net zero by 2030 rather than 2050.3

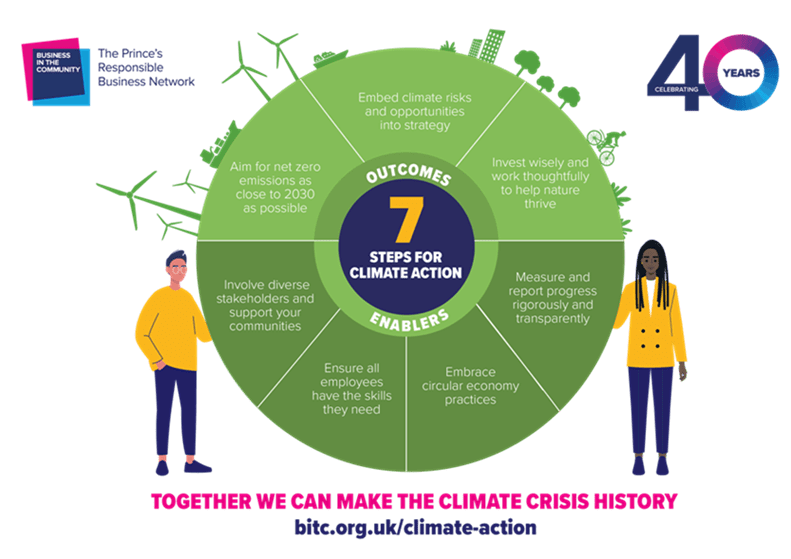

Seven Steps for Climate Action

Use our Seven Steps for Climate Action to develop your net-zero plans.

Focus on:

- building skills to thrive in a just transition

- involving diverse stakeholders

- embracing circular economy practices.

Download the Seven Steps for Climate Action

Making a just transition

BITC launched our work on a just transition at COP26, the United Nations (UN) Climate Change Conference of the Parties, held in Glasgow in 2021. As the UK responds to the climate crisis, we are urging businesses to deliver a fair and inclusive transition for people and nature.

Download BITC’s report The Right Climate For Business: leading a just transition, for research and recommendations on creating a net-zero, resilient future where people and nature thrive.

Engaging in nature stewardship and adopting a circular economy approach are critical elements of a fair and inclusive transition.

- Read how BITC can help you embed circular economy principles into your organisation.

- Learn how we can help you increase the resilience of urban and rural landscapes that protect natural assets, support wellbeing, and help climate proof community and business assets through our nature stewardship work.

UK-wide climate action

BITC’s national and regional leadership boards bring together business leaders, focusing on collaborative action to achieve net-zero carbon and a resilient future across the UK. They work together and with other stakeholders to:

- inspire businesses of all sizes to accelerate their efforts to deliver a net-zero, resilient future where people and nature thrive

- build skills to ensure employees at all levels can deliver the transition

- involve diverse stakeholders to co-create solutions to protect the most vulnerable and ensure the benefits of the transition are felt across communities.

Challenge 2030

A fair and inclusive transition is part of our Challenge 2030 campaign to make the climate crisis history in the next decade. It calls on businesses to increase:

- the scale of ambition in climate action plans, using Taskforce on Climate-related Financial Disclosures (TCFD) thinking to embed risks and opportunities into business as usual.

- the speed with which they will achieve net zero carbon, as close to 2030 as possible and aligned with the UN’s Race to Zero.

- their scope of influence, developing and implementing an inclusive strategy in collaboration with diverse stakeholders.

Work with us to accelerate the journey

- Join our Climate Action Leadership Team or a geographic Leadership Board to shape and implement our strategy. Alternatively you could fund and lead our work as a Just Transition Partner.

- Get involved in collaborative projects to investigate, co-create and activate solutions.

See our latest events.

Climate action: the time is now

Related content

The Right Climate For Leading a Just Transition

Collaboration between governments, businesses and civil society is critical if we are to act in time to avert the climate crisis.

Understanding the Social Cost of Carbon

Understand the key points about the social cost of carbon and the action that businesses should take to help make the climate crisis history.

In Your Hands: going circular for net zero

Key enablers and levers crucial to achieving a circular economy for net zero.

GLOBAL GOALS

TOGETHER WE CAN CHANGE THE WORLD

References

- Business in the Community (2022) The Right Climate For Business: leading a just transition, 25 January.

- ibid.

- Business in the Community (2021) Understanding the Social Cost of Carbon.